Credit Default Swaps (CDS) – Understanding the Basics

Credit default swaps (CDS) are financial derivatives that allow investors to protect themselves against credit risk. Credit risk is the likelihood of a borrower defaulting on their debt, which can result in a loss for lenders or investors. In this article, we will explore what CDS are, how they work, and their benefits and risks.

What are Credit Default Swaps?

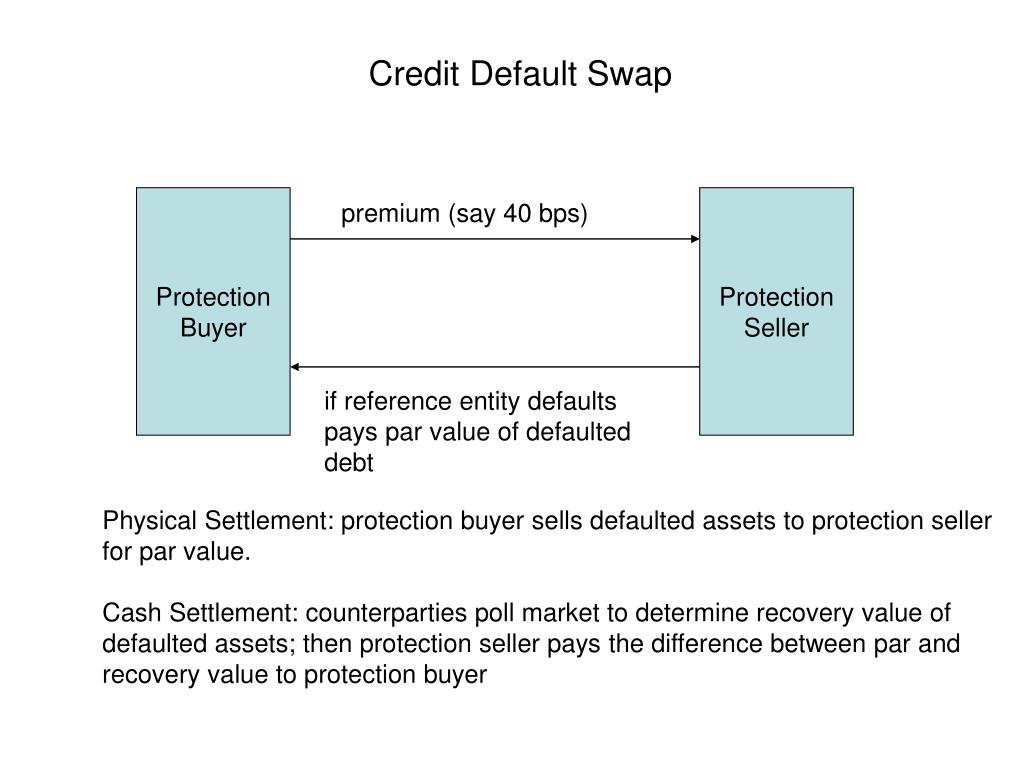

A credit default swap is an agreement between two parties where one party agrees to pay the other a premium in exchange for protection against the possibility of a borrower defaulting on its debt. The buyer of a CDS pays premiums regularly to the seller, who then compensates them if there is any event of default by the underlying borrower.

The underlying asset in a CDS could be an individual security like bonds or loans issued by companies or governments. It could also be broader entities such as sectors or even countries.

How do Credit Default Swaps Work?

To better understand how CDS works let us consider an example: Suppose Company A has borrowed $1 million from Bank B at 5% interest rate over ten years. If Bank B buys a CDS from another bank worth $1 million with Company A as an underlying asset, it means that Bank B has transferred its credit risk to another bank through this derivative contract.

If Company A defaults on its payment obligations at some point during those ten years, then Bank B would incur losses equivalent to $1 million plus interest accrued for the period not paid back by Company A. However, because Bank B bought a CDS from another bank worth $1 million with Company A as an underlying asset; it means that if Company A defaults on paying back her loan amount within those ten years agreed upon previously; then all losses incurred up until that point would be covered by this agreement instead- effectively limiting potential losses.

Benefits of Using Credit Default Swaps

1. Hedging against credit risk: CDS are an effective way to hedge against credit risk, especially for investors who hold large portfolios of debt securities.

2. Diversification: Investors can use CDS to diversify their investment portfolio and gain exposure to different sectors or assets.

3. Liquidity: Credit default swaps are highly liquid, meaning they can be bought or sold quickly and easily in the market.

4. Access to a wide range of underlying assets: CDS allows investors access to a broad range of underlying assets that they might not have been able to invest in otherwise, such as corporate bonds or government debt securities.

Risks Associated with Credit Default Swaps

1. Counterparty risk: If the seller of the CDS defaults on its obligations, then the buyer may not receive payment when an event of default occurs.

2. Basis Risk: There is no perfect match between the underlying asset and the protection provided by a CDS contract; this could lead investors into taking risks not intended due to basis differences between them

3. Market Risks – Like any other derivatives, credit default swaps carry market risks related to fluctuations in interest rates and credit spreads.

Conclusion

Credit default swaps (CDS) are complex financial instruments that allow investors to protect themselves from potential losses due to borrower defaults on debts like loans or bonds issued by companies/governments/sectors/countries etcetera while also providing benefits like diversification opportunities across various asset classes & sectors along with high liquidity options for trading purposes; however, it’s important for investors considering investing in these instruments first understand all relevant risks before making any commitments!

Leave a comment