Ladder Strategy: How to Build Wealth with Certainty

The ladder strategy is a smart way of investing your money that can help you build wealth over time. It is based on the idea of diversification, which means spreading your investments across different assets and maturities to balance risk and return.

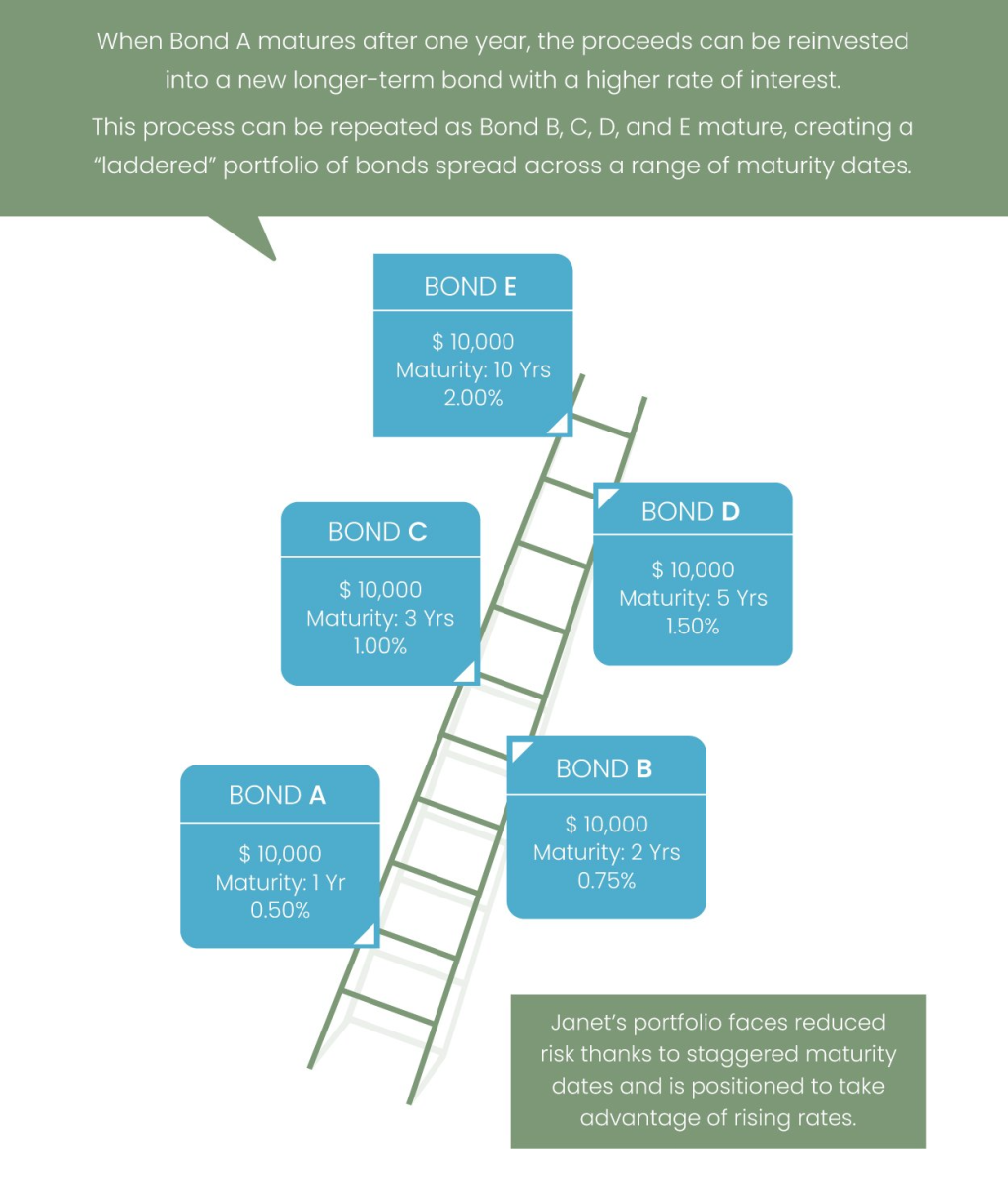

With the ladder strategy, you invest in a series of fixed income securities such as bonds or CDs (certificates of deposit) that mature at different times. By doing so, you create a “ladder” of investments that provides you with both regular income and liquidity.

Here’s how it works:

1. Start by dividing your investment capital into equal parts.

2. Invest each part in a fixed-income security that matures at different intervals (e.g., 1 year, 2 years, 3 years, etc.). The longer the maturity, the higher the interest rate.

3. As each security matures, reinvest the principal into another security with the longest maturity available within your portfolio.

4. Repeat this process until all securities have matured or until you achieve your investment goals.

The key benefit of this strategy is that it helps reduce risk by avoiding market timing decisions while providing steady cash flows from maturing securities over time. This means if one bond defaults or experiences volatility due to market changes, only a portion—not all—of your portfolio will be impacted.

Another advantage is flexibility; when short-term rates rise but long-term rates remain stable or fall slightly downward trend overall will increase returns more than locking money up in longer term loans which could lose value unexpectedly during periods when inflation impact prices negatively before those loans come due for repayment.)

However not every investor should use this plan since each individual has unique financial circumstances such as age ranges,career paths,personal liabilities,and many other factors affecting their finances.The ladder method may not be feasible for investors who need immediate access to funds because these types of investments are typically longer-term and may not have liquidity options.

In conclusion, the ladder strategy is a useful tool that can help you build wealth over time with certainty. It allows investors to diversify their portfolios while providing steady income streams and flexibility. However, it’s important to assess individual circumstances before deciding on any investment strategy.

Leave a comment